Benefits

Pension benefits, member services and communications

The 5.6 million members of the LGPS receive a life time membership service and regular information about LGPS benefits from their host LGPS pension fund upon joining the scheme, via annual benefits statements, upon leaving the scheme, or becoming a pensioner.

It is pleasing the vast majority of LGPS members appear to welcome and are content with the information and benefits they receive and the LGPS complies with Pensions Regulator guidance and codes in respect of member communications. The Pensions Regulator provides a report of its work below.

Based on reports from the the Pensions Ombudsman (PO) (see below) a small minority are recorded as making formal complaints about their pension benefits initially to the Pensions Advisory Service (TPAS) and if they are still not satisfied to the PO. The vast majority of cases concern employer decisions about ill-health retirement and or calculation of ill health retirement benefits. This is in line with most other occupational pension schemes.

Complaints handled by the Pensions Ombudsman

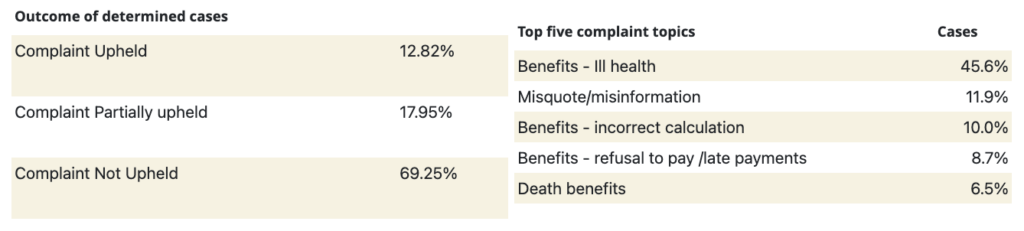

The Pensions Ombudsman (PO) determined 39 enquiries/complaints of a total of approximately 100 cases regarding the LGPS during the year. A breakdown of the complaints and Pensions Ombudsman (PO) determinations is shown below.

Most complaints were about ill health and other retirement benefits. The PO upheld <13% of complaints with the vast majority around 70% being either not upheld, or were rejected, referred elsewhere, or resolved without the need for a PO determination. This represents a significant shift from pervious years to closing investigations informally, without progressing cases to formal determination. Overall the LGPS has had relatively few upheld complaints.

Pension Ombudsman Determinations and Case topics

Report pages

Was this page helpful?